The Foreign Exchange Interbank Market .

The Foreign Exchange Interbank Market .

The global foreign exchange market is a large and evolving industry with millions of users. It's a complex space to navigate, so learning how it works can be a little daunting. In this survey, we'll take a look at the basics of foreign exchange markets and what you need to know about it before you start your first transaction.

The foreign exchange market (forex) is a market for the exchange of currencies and commodities. Forex markets are traded in dollars and euros and involve the purchase and sale of foreign trade and commodity futures and options.➡️THE ULTIMATE 3-STEP GUIDE TO INVESTING IN FOREX - New!

While there are a lot of official exchange rates that can be used by a foreign investor to trade forex, the main ones that are used are those from American Express Money Market, Bank of NY Mellon, and JPM Chase. In the past, many banks have been reluctant to issue their own foreign exchange rates as they felt that they could be accused of being profit-seeking entities. In the past decade, however, this view has changed as various foreign exchange rates have come under increased scrutiny.

I don't know why I've been so busy. I've been working on a blog for a couple of years now, I've been sharing my experiences with people and learning new things and I've been doing some fun stuff with my brother. It's not like I've been sleeping with anyone. Foreign exchange trading allows you to capture profits on the currencies you don't have available at the moment or to use them for other trades. Foreign exchange trading is a very popular way to trade, but actually implementing this concept is not easy. This article will show you the basics of foreign exchange trading. In the past few years there has been a surge in the number of currencies that can be traded on the foreign exchange market. This is mainly due to a combination of factors, including a global economic slump and a rise in the world's middle class, which means more people want to trade currencies.

Although officially listed as a "currency market," foreign exchange markets are not actually traded on a market exchange. They are a service offered by a local bank to its clients in a given geographic market that allows them to trade in foreign currency for a particular domestic currency.

The Foreign Exchange Market or Foreign Exchange Rate is an international pricing system used during international trade transactions. Each foreign exchange market has its own set of rates, but the most commonly used pair at any given time is the British Pound Sterling to the US Dollar It is important to note that the exchange rate may change on a daily basis, with the most recent daily rates being recorded each day. We all love a good story, and the story about the Inter-bank Exchange Market (FX) is a classic. In a few short decades, a once obscure commodity has gone from rock bottom to rock rock rock Currency trading on FX markets has soared from $7 billion to $80 billion, and the market is forecast to grow another $7 billion by 2015.

The Foreign Exchange Interbank Market (FEBI) is the world's leading foreign exchange information website, and also the world's leading source of research and analysis on global ar regional exchange rates and currency and commodity prices. On the site you will find feature stories, news and analyses on global and regional currencies and commodities, their interrelationships, and their recent trends.The Foreign Exchange Interbank Market is a center of activity for Banks, Commercial Banks, Investment Banks, Hedge Funds, Liquidity Providers etc.

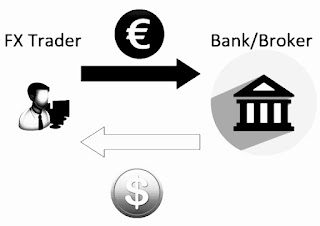

The Foreign Exchange Interbank Market (FX market) is a global market,Which facilitates the trading of currencies with foreign exchange traders, this is a Global market where you can trade in your currency and also make a profit in the long run. There is a great opportunity in this market for you and in fact there are many people who have made their fortune from this market. This is a Financial service where you will be able to trade in your currency and make a profit from the fluctuations in the exchange rates of these currencies that happens due to various causes such as interest rates, inflation etc.

The FX Market is one of the most popular and highly traded markets worldwide. The market has been growing phenomenally and hence is highly lucrative for traders. This is one of the most used method by people to invest their money and also trade. You can also purchase shares of Stock or fund with this so this FX Market is quite beneficial and lucrative for traders and investors alike.

What is The Foreign Exchange Interbank Market?

The Foreign Exchange Interbank Market is a forex market where foreign exchange rates are set by market participants. With an average daily trading volume of about $6.5 trillion US dollars, this is the largest spot foreign exchange market in the world. The Foreign Exchange Interbank Market is a forex market where foreign exchange rates are set by market participants. With an average daily trading volume of about $6.5 trillion US dollars, this is the largest spot foreign exchange market in the world

The foreign exchange market is a market where banks can engage in currency trading with each other. It is the most liquid market in the world and it is said to have a daily turnover of over $5 trillion. The foreign exchange market has three main components: spot, forwards and options. Spot means a transaction which takes place at a fixed future date between two parties. Advances and deposits are typically executed in the spot market with most transactions being settled on a net basis. Forward contracts are long-term contracts that typically have a maturity of up to one year. In this case, both parties agree that an amount will be paid or paid at a future date. Options are typically used by banks to manage their exposure to currency risks.

The Foreign Exchange Interbank Market uses a wide range of trades including the trading of stocks, bonds, and currencies. It is used by banks and financial institutions to manage their exchange rate risk. The foreign exchange market is the world's largest international trading platform for over-the-counter (OTC) derivatives. The Foreign Exchange Interbank Market is established to provide interbank quotations in currency in order to facilitate price discovery in the foreign exchange market. As the foreign exchange market is largely driven by market participants who trade on their own account, it is vital for these market participants to be able to gauge interbank prices.

The Foreign Exchange Interbank Market (FXI) is an electronic platform that allows users to trade in their own currencies against another currency. The FXI has developed a new way of transacting money between financial institutions and customers without the need for middlemen such as banks in the form of spot and forward transactions. Users in the FXI earn a yield (Interest) in foreign currency units in their preferred currency and receive in their native currency.

The Foreign Exchange Interbank Market is a computer-operated market where financial institutions can buy and sell short-term United States dollar foreign exchange. The market is the largest in the world, with over $1 trillion traded each day. The foreign exchange interbank market is a financial market that is used by banks, trading houses, money dealers and other financial institutions to effectively source liquidity in the form of short-term funds. How to start forex trading?

Summary...

Interbank market is a market that focuses on the exchange of currencies, such as the U.S. Dollar and Japanese Yen against one another. This is used by traders to determine the value of these currencies for future purchases and sales. The purpose of this market is to provide a more liquid marketplace where the exchange price is more reflective of the actual value. Thank you....!

Post a Comment